Locations

Bon Secours Foundation

Our Foundation teams in Maryland, South Carolina and Virginia coordinate charitable giving for all Bon Secours hospitals, facilities, services and community outreach programs in four regions:

Baltimore, MD - Bon Secours Baltimore Foundation

Greenville, SC - Bon Secours St. Francis Foundation

Hampton Roads, VA - Bon Secours Hampton Roads Foundation

Richmond, VA - Bon Secours Richmond Health Care Foundation

Locations

Bon Secours Foundation

Our Foundation teams in Maryland, South Carolina and Virginia coordinate charitable giving for all Bon Secours hospitals, facilities, services and community outreach programs in four regions:

Baltimore, MD - Bon Secours Baltimore Foundation

Greenville, SC - Bon Secours St. Francis Foundation

Hampton Roads, VA - Bon Secours Hampton Roads Foundation

Richmond, VA - Bon Secours Richmond Health Care Foundation

Local Impact

When you give to your local Bon Secours Foundation, you can be confident that every dollar stays local and directly impacts the most pressing needs of patients and citizens in your community.

Your Impact

Meet Mayra Saba

Meet Andrea & Ian

Cheryil Denny’s Story

Molly Frost’s Story

Meet Jerome Harris

Meet Bob & Susan

Meet Debra Long

Meet the Dunstan & Maddux Families

Susan Pilato’s Story

Meet Candace Pitts

News

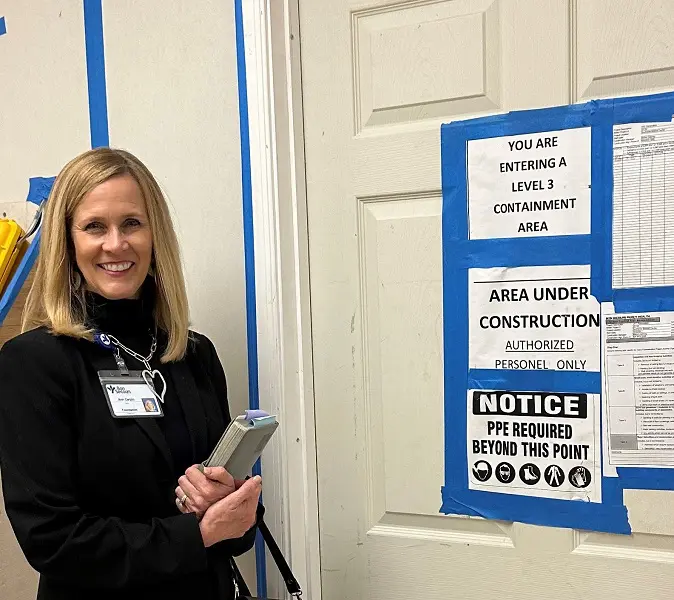

Construction begins on new Bon Secours Violence Response Team unit

Construction of a new 2,200 square-foot unit is underway at Bon Secours Southside Medical Center.